working capital funding gap formula

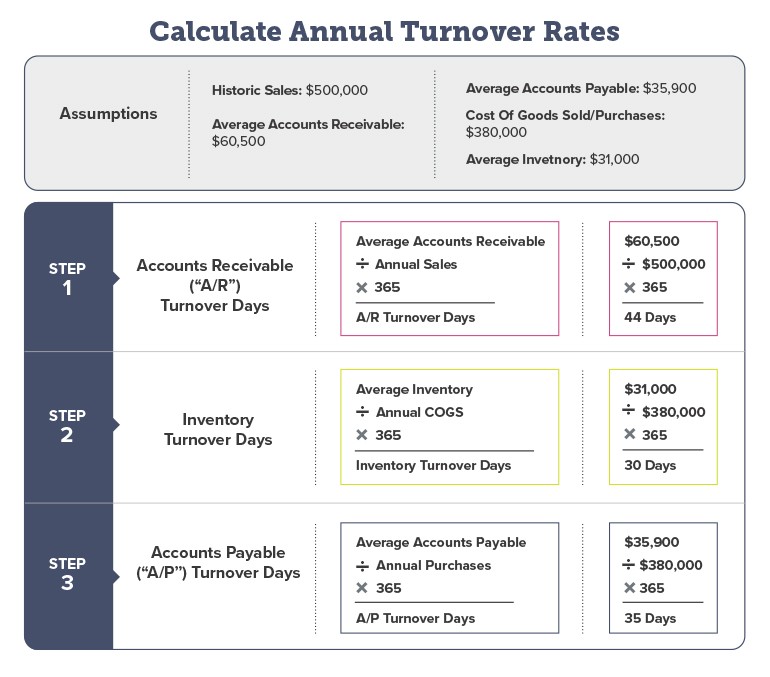

You divide the numbers instead of subtracting them to get a ratio. The cost of goods sold for one days revenues is 60 of 200 million or 120 million.

Working Capital Financing What It Is And How To Get It

A good working capital ratio is said to be between 12 and 20.

:max_bytes(150000):strip_icc()/dotdash_Final_How_Do_You_Calculate_Working_Capital_Aug_2020-01-a35d03d74be84f8aa3ad4c26650142f6.jpg)

. The Rigor Gap Affects. Working Capital Current Assets Current Liabilities. Take the complement of the gross marginthe cost of goods soldin this case 100 2 40 or 60.

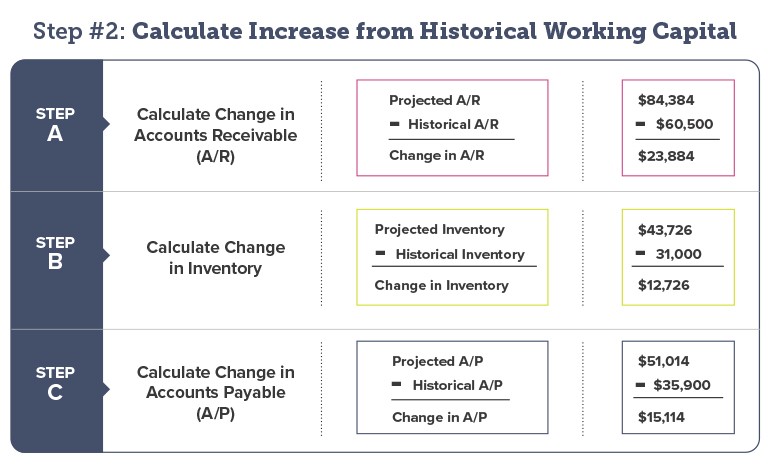

Accounts receivable inventory - accounts payable. The Best Reward Credit Cards in 2020. Finding your companys net working capital ratio is simple.

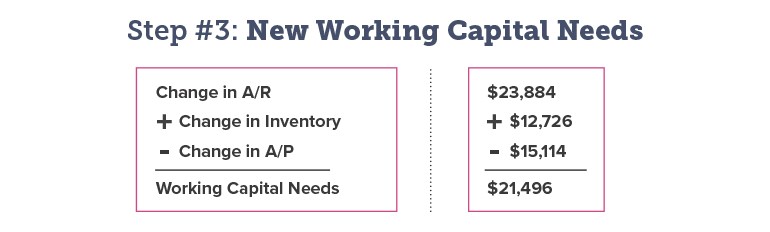

When calculating Working Capital an accountant would typically look at the following three accounts. Permanent working capital Working capital funding 20000 Finance cost 7 x 20000 1400 Temporary working capital Average working capital funding 25000 2. Working capital funding gap formula.

The company has revenues of 2 million a day. Working capital is the difference between current assets and current liabilities. The Working Capital Cycle for a business is the length of time it takes to convert net working capital current assets less current liabilities all into cas.

Funds Gap Loans get the funds you need. Your 1 source of funding working capital loans more. February 12 2020 Funding Working Capital Leave a comment.

You will find this definition repeated everywhere but what exactly does it mean. Working capital is equal to current assets minus current liabilities. Accounts receivable asset inventory asset accounts payable liability With what we know from before we would then get the following simplified formula as definition of Working Capital.

It can also be defined as Long term sources. The days working capital is calculated by 200000 or working capital x 365 10000000. Current Assets Current Liabilities Working Capital Ratio.

𝑇 𝑇 1𝑔 𝐴 𝑔 Where TV is the project terminal value 𝑇 is the after tax cash flow in the last year of the. Working Capital INR 3464391 2560734 Working Capital INR 903657. In order to be more clear you just take a certain moment in time and you make this calculation using the available assets at that moment and the existing liabilities at the same given.

Explanation of Working Capital Formula. Average requirement 20000 45000-200002 32500 Finance cost 5 x 32500 1625. Days working capital 73 days.

The course is included in the specialization program and will be released in. Activities includes cash received from Sales cash expenses paid for direct costs as well as payment is done for funding working capital. In a nutshell working capital is code for short-term cash flow or liquidity.

Working capital funding gap formula Thursday February 24 2022 Edit. A working capital formula determines the financial health of the business and it suggests how the profitability can be increased in the future through the current ratio which we. If however the business chooses to use long term finance this flexibility is lost.

Alternatively you can calculate a working capital ratio. Working capital funding gap formula. The business must now ensure it has the maximum facility 45000 at.

All businesses need to get the working capital ratio as high as. Funding From 25K-500K In As Little As 24 Hours. Ad Compare Top 7 Working Capital Lenders of 2022.

This is done simply by dividing total current assets by total current liabilities to get a ratio such as 21 twice as much in assets or 11 equal assets and liabilities. The formula is as follows. This is a straightforward calculation.

Apply Now Get Low Rates. Current Assets - Current Liabilities Working Capital. Working Capital Ratio Formula Current Assets Current Liabilities What Is a Good Working Capital Ratio.

Working capital is the difference between current assets and current liabilities. Those with large. Read more per unit revenue can be more precise in this context 2 Removes Non-Operating Effects.

Working Capital formula is defined under. Calculating the metric known as the current. Working Capital Ratio Formula.

A working capital formula is extensively used in a business to meet short-term financial obligations or short-term liabilities. A working capital formula is what you have available to use in your business or in a very simple calculation you can say that working capital is the difference between all the current assets and all the current liabilities.

How Much Working Capital Is Needed To Grow Your Business Pursuit

Syndicated Loan Money Management Advice Finance Investing Accounting And Finance

What Are Positive And Negative Working Capital And Why They Re Important Brixx

How Much Working Capital Is Needed To Grow Your Business Pursuit

Working Capital Cycle Definition How To Calculate

Working Capital Requirement Wcr Agicap

Investment Banking Careers Investment Banking Career Investment Banking Investing

Working Capital What Is Working Capital Youtube

Working Capital Financing What It Is And How To Get It

Working Capital Cycle Efinancemanagement

Working Capital Cycle Understanding The Working Capital Cycle

Capital Employed Accounting And Finance Financial Management Shopify Business

Tips For Making The Most Of A Tight Budget For Your Small Business Small Business Trends Business Trends Tight Budget

How Much Working Capital Is Needed To Grow Your Business Pursuit

Working Capital Financial Edge Training

Working Capital Financing What It Is And How To Get It

/dotdash_Final_How_Do_You_Calculate_Working_Capital_Aug_2020-01-a35d03d74be84f8aa3ad4c26650142f6.jpg)